For financial planners, attracting new clients often hinges on being discoverable online. When potential clients search for financial advice, you want your name to appear at the top of the search results. This is where the power of SEO for financial planning comes into play. A well-executed SEO strategy can significantly impact your online visibility, connecting you with individuals actively seeking your services. This guide explores the key components of SEO for financial planning, providing actionable steps to improve your search engine rankings, attract more qualified leads, and ultimately grow your business. From keyword research and content creation to technical optimization and local SEO tactics, we’ll cover everything you need to know to establish a strong online presence and achieve lasting success in the competitive financial planning landscape.

Key Takeaways

- Attract ideal clients with SEO: Connect with people actively searching for financial advice online, boosting your visibility and practice growth.

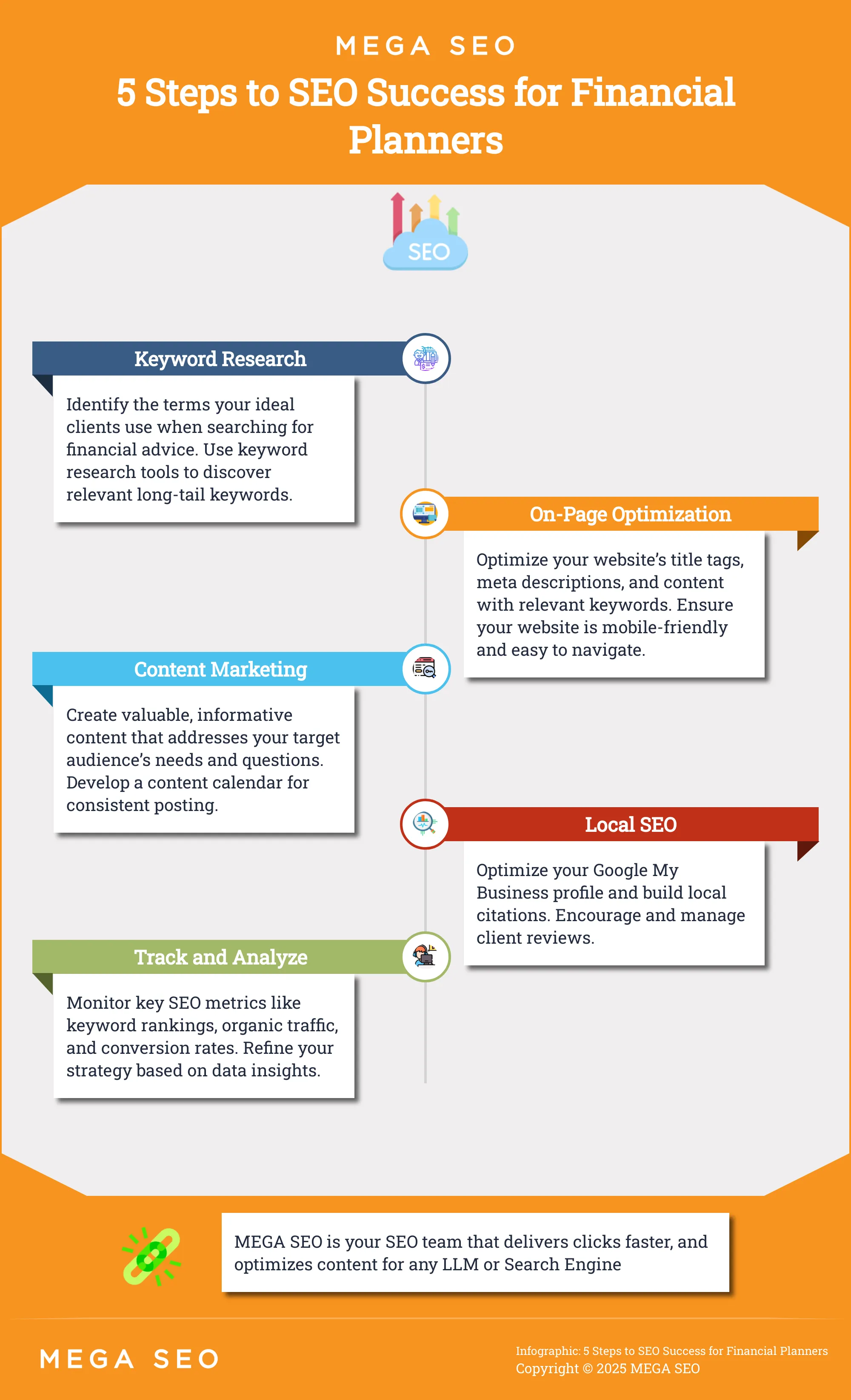

- Combine diverse SEO strategies: Integrate keyword research, on-page and technical optimization, content marketing, and local SEO for a comprehensive approach.

- Track, analyze, and refine your SEO: Monitor key metrics, analyze data, and adapt your strategies to maximize results and achieve your business goals.

What is SEO and Why Does it Matter for Financial Planners?

As a financial planner, you’re an expert in managing finances, but are you easy to find for the people who need your expertise? Potential clients search online for financial advice. Search engine optimization (SEO) helps you connect with these individuals. This section explores what SEO means for financial planning and why online visibility is crucial for financial advisors.

What is SEO in Financial Planning?

SEO for financial advisors is the practice of optimizing your online presence to rank higher in search engine results pages (SERPs). When potential clients search for terms like “financial advisor near me” or “retirement planning,” a strong SEO strategy ensures your website appears near the top of those results. This SEO strategy helps you attract qualified leads actively seeking financial guidance. Keyword optimization is a cornerstone of SEO. In finance, using long-tail keywords like “best investment strategies for young professionals” is particularly valuable since users often search for specific financial information.

Why is Online Visibility Important for Financial Advisors?

Online visibility is essential for financial advisors. A strong SEO strategy improves your website’s ranking, making you more visible to potential clients and building trust and credibility. When your website appears prominently in search results, potential clients see you as a reputable and trustworthy advisor. In a competitive market, strong online visibility is essential for attracting and retaining clients. A robust online presence helps you reach a wider audience, establish yourself as an expert, and grow your business. Investing in SEO is investing in the future of your financial planning practice.

Key Components of Effective SEO for Financial Advisors

Attracting new clients online requires a strong SEO strategy. For financial advisors, this means understanding how potential clients search for financial advice and tailoring your online presence to meet their needs. Let’s break down the key components of effective SEO:

Research Keywords for Financial Planning

Keyword research is the foundation of any successful SEO strategy. It’s about understanding the words and phrases people use when searching for financial advice online. As Ranktracker points out, long-tail keywords are especially valuable, comprising roughly 57% of finance-related searches. These longer, more specific phrases, such as “financial planning for retirement in California,” often indicate a user further along in the buying cycle and ready to engage with a financial advisor. MEGA SEO’s keyword research tools can help you identify these valuable long-tail keywords and understand search volume and competition.

Optimize On-Page Elements

On-page SEO focuses on optimizing the elements within your website. This includes crafting high-quality, informative content that directly addresses the questions your target audience is asking. Think about the structure of your content too. Use headings, short paragraphs, and clear language to make it easy to read and understand. Internal linking, connecting different pages within your website, is also crucial for on-page SEO, as explained in Kestra Financial’s guide for financial advisors. MEGA SEO can help streamline these on-page optimization tasks.

Create and Optimize Content

Content is king in SEO, especially for financial advisors. Creating valuable, insightful content positions you as a thought leader in your field. This isn’t just about blogging. It includes creating resources like guides, ebooks, and webinars that offer real value to your potential clients. As Sarah Moon & Co. emphasizes, a content-first approach is essential for service-based businesses. Generic SEO advice won’t cut it. You need targeted, high-quality content that resonates with your ideal client. MEGA SEO’s content generation features can help you create this type of content efficiently.

Build Links

Off-page SEO encompasses activities outside your website that contribute to your search engine rankings. A primary focus of off-page SEO is building high-quality backlinks. Backlinks are links from other reputable websites to your content. These links act as votes of confidence, signaling to search engines that your website is a trustworthy and authoritative source of information. This is a key factor in improving your search visibility. Schedule a demo to see how MEGA SEO can help you automate and streamline your link-building efforts.

Research Keywords for Financial Planning Websites

Keyword research is the foundation of any successful SEO strategy. It’s about understanding what your potential clients are searching for online and using those insights to create content that attracts them to your website. For financial planners, this means identifying the terms people use when seeking financial advice, services, or information.

Understand User Intent in Financial Searches

Before diving into keyword research tools, take a moment to consider user intent. What are people actually looking for when they type certain phrases into a search engine? Are they seeking information, comparing services, or ready to hire a financial advisor? Understanding user intent helps you target the right keywords and create content that satisfies their needs. For example, someone searching for “best financial advisor near me” clearly has a different intent than someone searching for “how to calculate retirement savings.” As Ranktracker notes, long-tail keywords, like “financial advisor for small business owners in Austin,” are increasingly important in finance as users search for very specific information. Tailoring your content to these specific searches can significantly improve your visibility to the right audience. You can learn more about creating customized posts with MEGA SEO.

Use Keyword Research Tools in Finance

While understanding user intent is crucial, keyword research tools provide the data you need to refine your strategy. These tools help you discover relevant keywords, analyze their search volume (how often they’re searched), and assess their competition (how difficult it is to rank for them). Many SEO tools offer features specifically designed for keyword research, competitive analysis, and on-page optimization. Some popular options include SEMrush, Ahrefs, and Moz Keyword Explorer. Nuoptima emphasizes the importance of using these tools to refine your SEO strategy and optimize your content effectively. MEGA SEO also offers robust keyword research tools that can help you identify valuable keywords and track your SEO progress. Consider booking a demo to see how MEGA SEO can automate your keyword research.

Choose Between Long-Tail and Short-Tail Keywords

Keywords generally fall into two categories: short-tail and long-tail. Short-tail keywords are broad terms like “financial planning” or “investment advice.” They have high search volume but also high competition. Long-tail keywords, on the other hand, are more specific phrases like “retirement planning for teachers” or “best investment strategies for first-time homebuyers.” While they have lower search volume individually, they often attract more qualified leads because they reflect a more specific user intent. Promodo highlights that long-tail keywords dominate finance-related searches, making up about 57% of queries. Focusing on long-tail keywords can be a highly effective strategy for financial advisors looking to connect with potential clients who are further along in the buying process. By targeting a mix of both short-tail and long-tail keywords, you can create a comprehensive SEO strategy that attracts a wider range of potential clients. Access more resources on SEO best practices from MEGA SEO.

Optimize On-Page Elements for Financial Planning Websites

Optimizing on-page elements is crucial for improving your financial planning website’s visibility in search results. It’s how you tell search engines what your website is about and why it’s relevant to specific searches. Think of it as making a great first impression.

Optimize Title Tags and Meta Descriptions

Title tags and meta descriptions are the first things people see in search results. Your title tags should accurately reflect the page content and include relevant keywords. Keep them concise (around 50–60 characters). Meta descriptions provide a brief summary and entice clicks by highlighting your value proposition. Aim for 150–160 characters. Kestra Financial offers helpful advice on SEO for financial advisors.

Create SEO-Friendly URLs

URLs should be short, descriptive, and easy to understand. Use relevant keywords to signal the page’s topic. Avoid long strings of numbers or random characters. A clean URL structure also improves user experience. For more tips, review Kestra Financial’s insights.

Improve Site Speed and User Experience

Site speed is critical for user experience and SEO. A fast-loading website keeps visitors engaged and signals quality to search engines. Make sure your website is optimized for mobile, as most people access financial information on their phones. Google’s PageSpeed Insights tool can help analyze your site speed.

Implement Schema Markup

Schema markup helps search engines understand your content. For financial planning websites, it can highlight services, testimonials, and other details, leading to richer search results and increased click-through rates. The Integrated Financial Group offers a comprehensive SEO guide. MEGA SEO’s automated tools can simplify implementing and managing schema markup.

Content Marketing Strategies for Financial Planners

Content marketing is crucial for financial planners to attract and engage potential clients. By creating valuable, optimized content, you can establish yourself as a trusted advisor and improve your online visibility.

Create Valuable Content

Creating high-quality content is essential for establishing yourself as a thought leader in financial planning. This attracts potential clients and builds trust and authority. Focus on providing informative resources that address your target audience’s pain points. Consider creating blog posts, articles, ebooks, webinars, and videos that offer practical advice on topics like retirement planning, investment management, and financial goal setting. For example, you could write a blog post on “How to Create a Retirement Plan in Your 30s” or host a webinar on “Understanding Investment Options for Millennials.” By consistently delivering valuable content, you can position yourself as a go-to resource for financial planning advice. For more tips, check out Sarah Moon & Co.’s guide for financial advisors.

Develop a Content Calendar

A content calendar is vital for financial planners. It helps plan and schedule content to ensure consistent delivery and audience engagement, which is crucial for maintaining visibility. Your content calendar should outline the topics you’ll cover, the format of each piece, the target publication date, and distribution channels. This organized approach will help you stay on track and maintain a consistent flow of valuable content. A well-defined content strategy is key for long-term success.

Optimize Content for Users and Search Engines

On-page optimization is key to effective SEO. This includes using relevant keywords in titles, headings, and body text, creating high-quality content, and optimizing website structure and meta tags to enhance user experience and search engine visibility. Research keywords your target audience uses and incorporate them naturally into your content. Ensure your website is easy to use and has a clear structure, making it simple for users and search engines to find information. Optimizing meta descriptions can also significantly improve your click-through rates from search engine results pages. Consider booking a demo to learn how MEGA SEO can help automate these tasks.

Understand E-A-T in Finance Content

E-A-T (Expertise, Authoritativeness, Trustworthiness) is particularly important for financial content. Financial planners should ensure their content reflects these qualities to build credibility and trust with potential clients. Highlight your credentials, experience, and qualifications in your content and website bio. Showcase client testimonials and case studies to demonstrate your expertise and build trust. Link to authoritative sources and industry publications to further enhance your credibility. The Integrated Financial Group offers helpful strategies for financial advisors. By focusing on E-A-T, you can establish yourself as a reputable and trustworthy financial advisor.

Technical SEO for Financial Planning Websites

Technical SEO can feel intimidating, but it’s crucial for ensuring your financial planning website ranks well. These behind-the-scenes optimizations make your site easy for search engines to crawl and understand, ultimately improving visibility.

Optimize for Mobile

Most people search for financial advisors on their smartphones. If your website isn’t mobile-friendly, you’re missing out on potential clients. A responsive design that adapts to different screen sizes is a must-have. Test your site on various devices to ensure a seamless experience for all users. Page speed is also critical on mobile. Optimize images and minimize unnecessary code to keep your site fast. Consider using Google’s PageSpeed Insights tool to identify areas for improvement.

Improve Site Architecture and Internal Linking

A well-structured website benefits both users and search engines. Think of your site architecture as a roadmap. It should guide visitors to the information they need quickly and easily. Use clear headings and short paragraphs to organize your content. Internal links connect relevant pages within your website, improving navigation and helping search engines understand the relationship between different topics. For example, link your blog posts about retirement planning to your retirement planning services page. A clear sitemap is also essential for helping search engines crawl your website efficiently.

Optimize for Voice Search

More and more people use voice search to find information online, including financial advice. When optimizing for voice search, focus on long-tail keywords and natural language. Think about how people would ask a question verbally. For example, instead of targeting the keyword “financial advisor,” you might target “best financial advisor for young families in Austin.” This conversational approach aligns with how people use voice search. Tools like AnswerThePublic can help you discover the questions people are asking related to financial planning. Use these insights to create content that addresses those questions directly.

Local SEO for Financial Advisors

Local SEO is crucial for financial advisors who want to attract clients in their area. Unlike broad SEO strategies, local SEO helps you connect with people actively searching for financial advice nearby. This hyperlocal approach is essential for growing a client base in a specific region.

Optimize Google My Business

Your Google Business Profile is your online storefront. A complete and optimized profile helps potential clients discover your services, especially in “near me” searches. Ensure your profile is accurate, up-to-date, and includes relevant keywords. Think about what a potential client might search for—terms like “financial advisor [your city]” or “retirement planning [your area]”. Regularly posting updates and responding to reviews shows Google (and potential clients) that you’re actively engaged. Kestra Financial recommends a strong Google My Business presence as a cornerstone of local SEO for financial advisors.

Build Local Citations and Backlinks

Citations are online mentions of your business, including your name, address, and phone number (NAP). Consistent NAP information across different platforms builds credibility with search engines. Think local directories, industry-specific websites, and even your local Chamber of Commerce. Backlinks from reputable local websites further enhance your authority and improve your search ranking. These could be links from local news sites, community blogs, or professional organizations. Marketing Scoop highlights local SEO as key for financial advisors targeting potential clients within a specific service area.

Manage Client Reviews

Client reviews are social proof. They build trust and influence potential clients. Encourage satisfied clients to leave reviews on platforms like Google, Yelp, and industry-specific review sites. Respond to both positive and negative reviews professionally and promptly. Addressing negative reviews shows you care about client feedback and can even turn a negative experience into a positive one. Kestra Financial emphasizes the importance of online reviews for building trust and boosting local SEO. Positive reviews can significantly impact your visibility and attract new clients.

Measure SEO Success

Once you’ve put time and effort into your SEO strategy, how do you know if it’s working? Measuring SEO success involves tracking the right metrics, analyzing data, and setting achievable goals. Here’s how to assess your SEO performance:

Track Key SEO Metrics

You can track several key metrics to understand how your SEO efforts are impacting your online presence. Keyword rankings show you where your site appears in search results for relevant keywords. Higher rankings generally mean more visibility. Talking to an SEO provider’s current clients can also be valuable, giving you insights into their results and experience, especially within the financial services industry. MEGA SEO offers automated tools to track these metrics and more, simplifying the process for financial advisors.

Monitor and Analyze SEO Data

Use tools like Google Analytics and Google Search Console to monitor website traffic, rankings, and other important metrics. These platforms provide a wealth of data about user behavior and search performance. Other tools like Moz and Semrush can also be valuable resources. Key metrics to watch include organic traffic, engagement rate (how users interact with your content), conversion rate (how many visitors become clients), keyword rankings, and click-through rate (how often people click on your search result in search engine results pages or SERPs). Analyzing this data helps you understand what’s working and what needs improvement. Schedule a demo to see how MEGA SEO can automate data analysis and reporting, saving you time and resources.

Set Realistic SEO Goals

SEO is a long-term strategy, and results don’t happen overnight. Start with small, achievable goals, like improving your ranking for a specific long-tail keyword or increasing organic traffic by a certain percentage. Consider running small, inexpensive tests, such as paid advertising campaigns, to validate your keyword strategies before investing heavily in a long-term SEO campaign. This approach allows you to refine your strategy and measure progress effectively. Explore MEGA SEO’s resources for more tips on setting realistic SEO goals and maximizing your results.

Avoid Common SEO Mistakes

Even with a solid SEO strategy, some common mistakes can hinder your progress. Let’s explore how to sidestep these pitfalls and keep your SEO efforts on track.

Create Quality Content

One of the biggest SEO mistakes is overlooking the importance of quality content. Search engines prioritize valuable, informative content that truly addresses user needs. As Sarah Moon and Company emphasizes in their guide to SEO for financial advisors, a content-first approach is crucial for establishing yourself as a thought leader. This means creating content that not only incorporates relevant keywords but also provides genuine value to your audience. Don’t just write for search engines; write for people. Focus on answering their questions and providing insightful information that keeps them engaged. Kestra Financial also highlights this in their SEO advice, stressing the need for high-quality, informative content. By prioritizing user experience and creating content that resonates with your target audience, you’ll naturally attract more organic traffic and improve your search rankings. Consider using MEGA SEO’s content generation tools to streamline this process.

Prioritize Mobile and Local SEO

In today’s mobile-first world, optimizing your website for mobile devices is non-negotiable. Many financial advisors search for information on the go, so a seamless mobile experience is essential. Additionally, local SEO plays a vital role in attracting clients within your service area. Marketing Scoop’s SEO guide points out that local optimization allows you to target potential clients precisely within your geographical area. This involves optimizing your Google My Business profile and incorporating local keywords into your content, as suggested by Kestra Financial. Think about the terms potential clients in your area might use when searching for financial advice. By incorporating these local keywords strategically, you can improve your visibility in local search results and attract more clients from your community. MEGA SEO’s keyword research tools can help you identify relevant local keywords.

Build Backlinks and Authority

Building a strong backlink profile is crucial for establishing credibility and authority in the eyes of search engines. Backlinks are essentially votes of confidence from other websites, signaling to search engines that your content is valuable and trustworthy. Sarah Moon and Company recommends building high-quality backlinks from reputable websites. This not only improves your search rankings but also drives referral traffic to your site. Kestra Financial also emphasizes the importance of backlinks, explaining that they demonstrate trustworthiness. Focus on earning backlinks from authoritative sources within the financial industry. This could involve guest blogging, participating in industry forums, or collaborating with other reputable businesses. By building a network of high-quality backlinks, you’ll solidify your online presence and position yourself as a trusted authority. Consider exploring MEGA SEO’s resources for more insights on building authority and optimizing your backlink strategy.

Related Articles

- Unlocking the Secrets to Finding and Securing Clients for Your SEO Business – MEGA SEO | Blog

- Unconventional SEO Tactics That Actually Work: Surprising Strategies for Boosting Your Rankings – MEGA SEO | Blog

- The Hardest Parts of SEO: Challenges and Strategies for Success – MEGA SEO | Blog

- Importance of Content Quality and Relevance in Building Site Authority for SEO – MEGA SEO | Blog

- Optimizing Your Website for Local Search: Essential SEO Strategies for Regional Businesses – MEGA SEO | Blog

Frequently Asked Questions

Why is SEO important specifically for financial planners?

Financial planning is a competitive field, and potential clients often turn to online searches when looking for an advisor. SEO helps financial planners stand out from the competition, attract qualified leads, and establish credibility online. It’s a crucial tool for growing your client base in today’s digital world.

What are some common keywords used in financial planning SEO?

Keywords in financial planning SEO vary widely depending on the specific services offered. They can range from broad terms like “financial advisor” or “retirement planning” to more specific long-tail keywords like “financial planning for small business owners” or “best retirement communities in Florida.” Understanding user intent is key to choosing the right keywords.

How can I improve my website’s ranking in search results?

Improving your website’s ranking involves a combination of on-page and off-page optimization strategies. On-page optimization focuses on elements within your website, such as content quality, keyword usage, and site structure. Off-page optimization involves building high-quality backlinks from reputable websites and managing your online reputation. Tools like MEGA SEO can automate and streamline many of these tasks.

What is the role of content marketing in SEO for financial advisors?

Content marketing plays a vital role in attracting and engaging potential clients. Creating valuable, informative content, such as blog posts, articles, and webinars, positions you as a thought leader and builds trust with your audience. Optimized content also improves your website’s visibility in search results, driving organic traffic and generating leads.

How can I measure the success of my SEO efforts?

Measuring SEO success involves tracking key metrics like keyword rankings, organic traffic, and conversion rates. Tools like Google Analytics and Google Search Console provide valuable data insights into your website’s performance. Setting realistic goals and regularly monitoring your progress are essential for a successful SEO strategy. MEGA SEO offers automated tools to simplify tracking and reporting, making it easier to assess your SEO ROI.